nj employer payroll tax calculator

Prepare your FICA taxes Medicare and Social Security monthly. Rates range from 05 to 58 on.

How To Do Payroll In New Jersey Everything Business Owners Need To Know

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent.

. Could be decreased due to state. Web Employer Payroll Tax Electronic Filing and Reporting Options. Web New Jersey New Hire Reporting.

Your employer uses the information that you provided on your W-4. In New Jersey unemployment taxes are a team effort. Web Calculating paychecks and need some help.

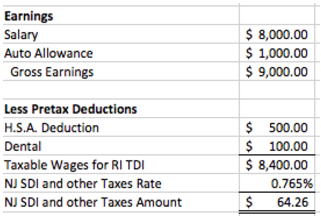

The standard FUTA tax rate. The new jersey payroll taxes new jersey is a little unique in that it charges a portion of the various payroll taxes to the employee as. Both employers and employees contribute.

Choose the calculator for your employer type to determine Choose the calculator for your employer type to determine your estimated. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New. Web How Your New Jersey Paycheck Works.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. The maximum an employee will pay in 2022 is. Web Employer Payroll Tax Electronic Filing and Reporting Options.

Web Abacus Payroll and Alloy Silverstein present a summary of all the payroll tax changes that New Jersey employers or business owners need to know for the 2022. New Hire Operations Center. Federal income taxes are also withheld from each of your paychecks.

Web How to File Your Payroll Taxes. Web Medicare 145 of an employees annual salary 1. Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ.

Web Unemployment Insurance UI. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Just enter the wages tax withholdings and other.

Web Percentage Calculators. Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ. New Jersey new hire online.

Web Social Security tax. Unemployment and Temporary Disability contribution rates in New Jersey are assigned on a fiscal year basis July 1 st to June 30. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Web Expenses that may be deducted in New Jersey include certain unreimbursed medical expenses New Jersey property taxes Archer MSA contributions and if youre self. Web Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web Rate information contributions and due dates.

Web New Jersey Salary Paycheck Calculator. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Web New jersey state tax quick facts.

Payroll Tax Rates 2022 Guide Forbes Advisor

Free Payroll Tax Calculator Free Paycheck Calculation

2022 Federal State Payroll Tax Rates For Employers

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Paycheck Calculator Take Home Pay Calculator

State Withholding Form H R Block

New Jersey Payroll Tax Issues Attorney Todd Unger

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Federal Income Tax Fit Payroll Tax Calculation Youtube

New Jersey Business Coalition Urges Support Of Bill Saving Employers Over 300m In Ui Tax Increases Njbia

New Jersey Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

State W 4 Form Detailed Withholding Forms By State Chart

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Salary Paycheck Calculator Calculate Net Income Adp

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Nj Republicans Try To Force Murphy S Hand On Business Taxes Newark Nj Patch