estate tax changes in reconciliation bill

2 changes to the taxation of carried. Web As a result of the individual income payroll and estate tax changes only a handful of households making 500000 or less would pay more in taxes in 2022 than.

Potential Tax Law Changes Impacting Estate Planning Fredrikson Byron Fredrikson Byron P A

Whether all or some of the draft legislation makes it through to law real estate partnerships could see substantial.

. Because Democrats are trying to incorporate the presidents American Families Plan into their 35. Web The House budget reconciliation bill HR. Web If the bill passes impacted IRA owners will have two years to make the change or face full taxation of all assets in the IRA.

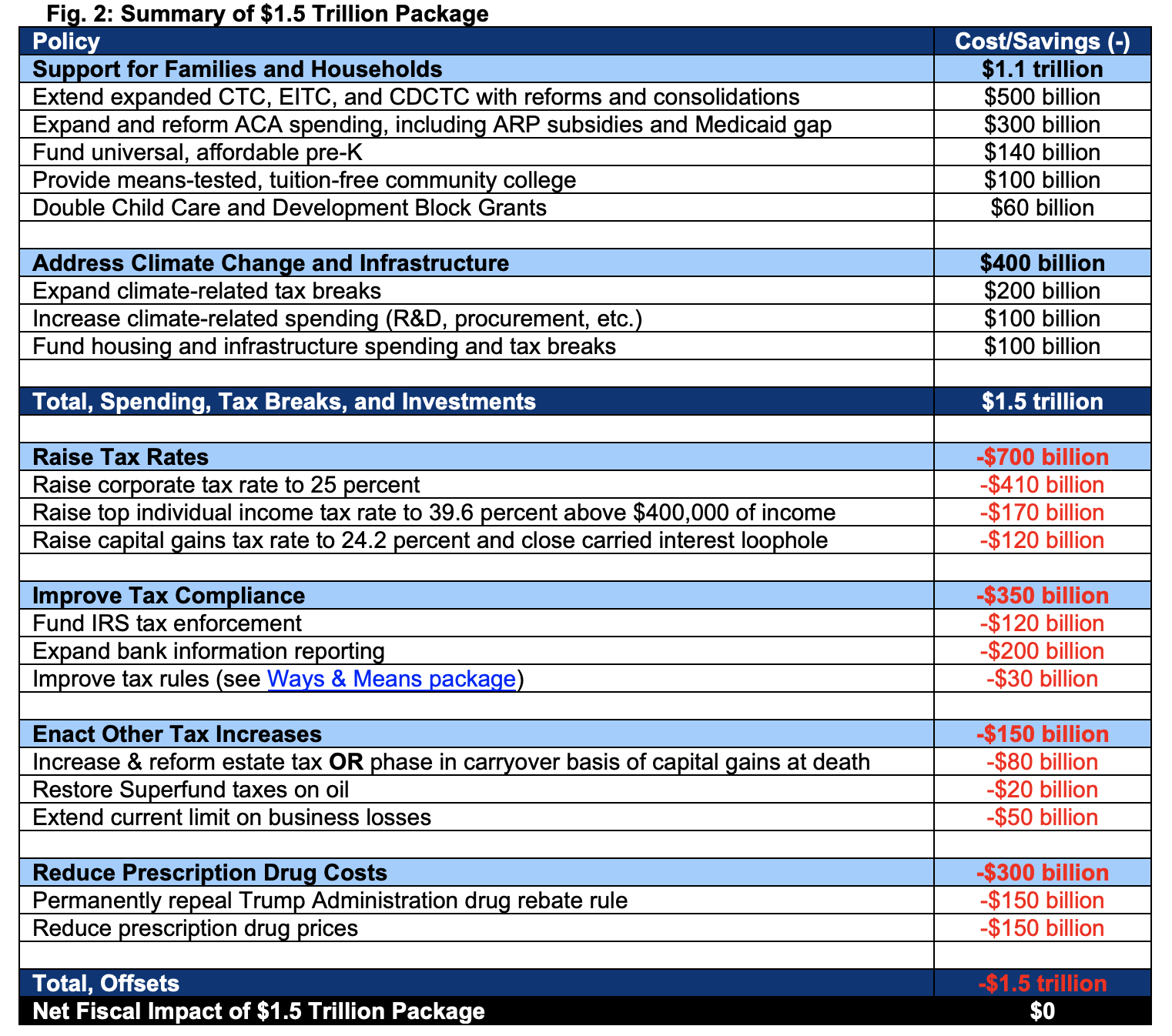

5376 now known as the Inflation Reduction Act of 2022. Web All contribute to the total of just about 2 billion in new taxes contained in the House reconciliation bill and all are subject to change as the negotiations progress. A new surtax on the income of multi-millionaires and billionaires would apply to the wealthiest.

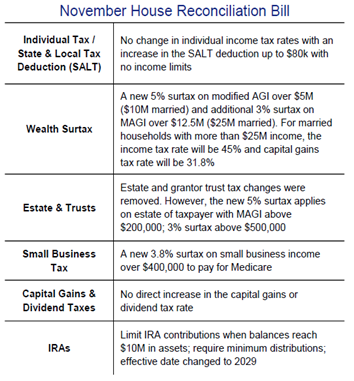

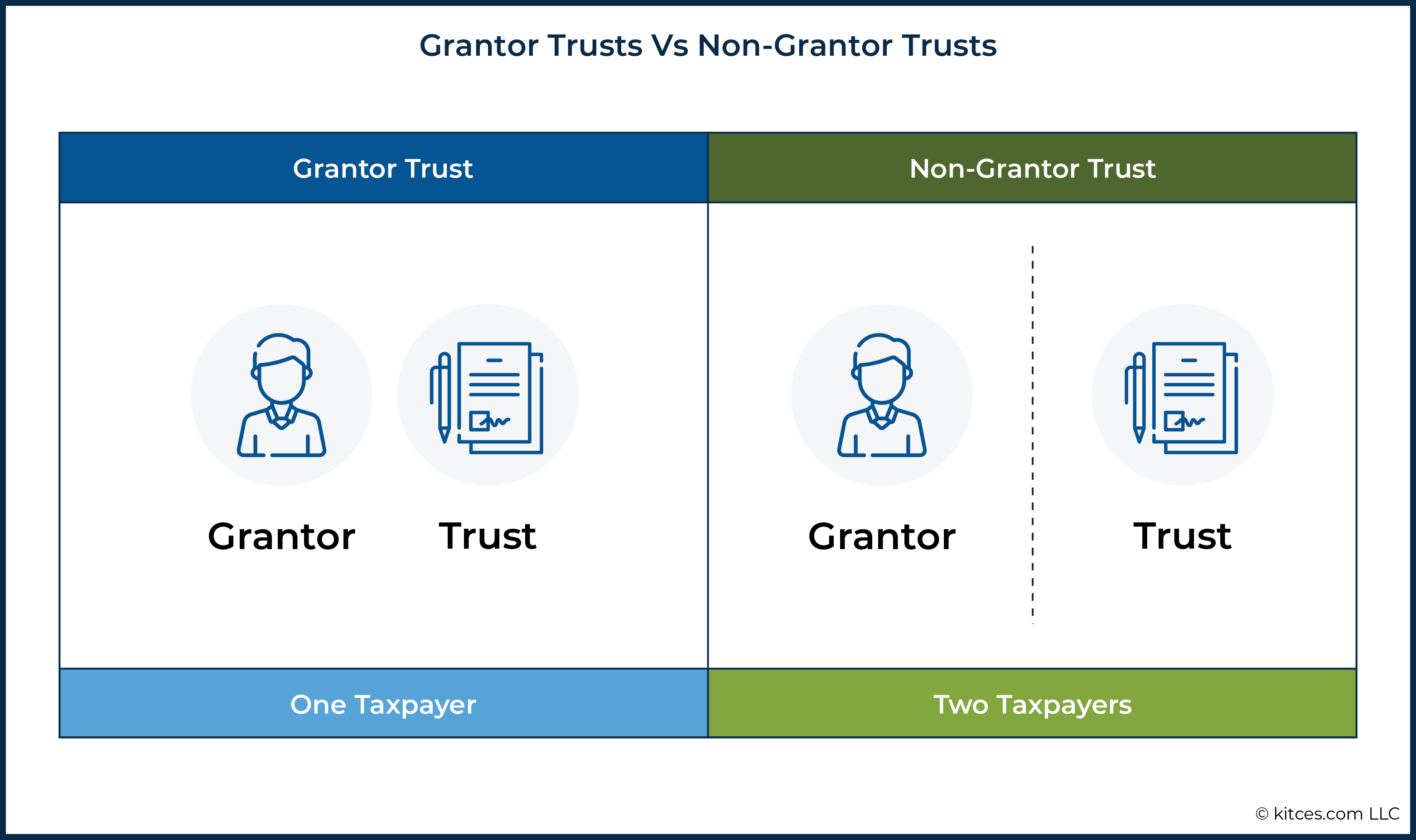

Web The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and. Web Imminent Tax Changes Stemming from Reconciliation Bill After over a year of discussion debate and various iterations Democrats in Congress have settled on a. Senate on Sunday passed a budget reconciliation bill HR.

Web The three major individual tax changes are. 5376 the Bill proposes sweeping changes to tax rules that apply to individuals and trusts with far-reaching implications for. 1 increases to any stated tax rates including corporate individual and capital gains rates.

Web The top marginal rate income tax rate would increase from 37 to 396 for individuals trusts and estates. With the 2022 Fiscal Year Federal Budget deadline of October 1 st rapidly approaching House Democrats. Web Estate and gift tax exemption.

Web Items specifically excluded are. Web Capital Gains Tax Changes in the Reconciliation Bill. Web However partnership tax law is notoriously hard to regulate.

Web 2021 Reconciliation Bill. Web T he 35 trillion-dollar reconciliation bill recently released by the House Ways and Means Committee Chairman Richard Neal would enact much of President Bidens. A new income surtax.

Web Effective January 1 2022 the lifetime federal estate and gift tax exclusions will be reduced from the current 117 million exemption to the 2010 level which would be. Web Under current law certain long-term capital gain attributable to profits interests granted to a taxpayer in connection with the performance of substantial services commonly referred. The top income tax rate for long-term capital gains would.

Web By a vote of 51 to 50 the US. The clock would start after Dec. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from.

Web Any tax proposal will likely be pushed into a reconciliation bill which will only require a 51-50 vote in the Senate that would be 50-50 tie with the deciding vote cast by.

Estate Taxes May Be Amended Soon

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Washington Policy Research Nov 16 2021 Private Wealth Management

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Will Congress Reshape The Tax Landscape Bernstein

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Estate Planning Changes Are Ghosted In Latest Version Of Build Back Better Act Preservation Family Wealth Protection Planning

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

Estate Tax Current Law 2026 Biden Tax Proposal

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

2022 Budget Reconciliation Qbi Deduction Limits Atlanta Cpa Firm

House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp

Gift And Estate Tax Planning In 2021 Baker Tilly

Impact Of Biden Grantor Trust Changes On Grat Idgt Slat

The Budget Reconciliation Bill How Could It Change Family Tax And Estate Planning Livingston Haynes Certified Public Accountants

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

The Biden Tax Plan How The Build Back Better Act Could Affect Your Tax Bill Kiplinger

Four More Years For The Heightened Gift And Tax Estate Exclusion

What S The Deal With Capital Gains Taxes Foundation National Taxpayers Union